Taking control of your financial life requires the knowledge to make better decisions. Yet, from saving to investing, financial advice can often seem complicated or boring and rarely produces a feeling of meaning or connection.

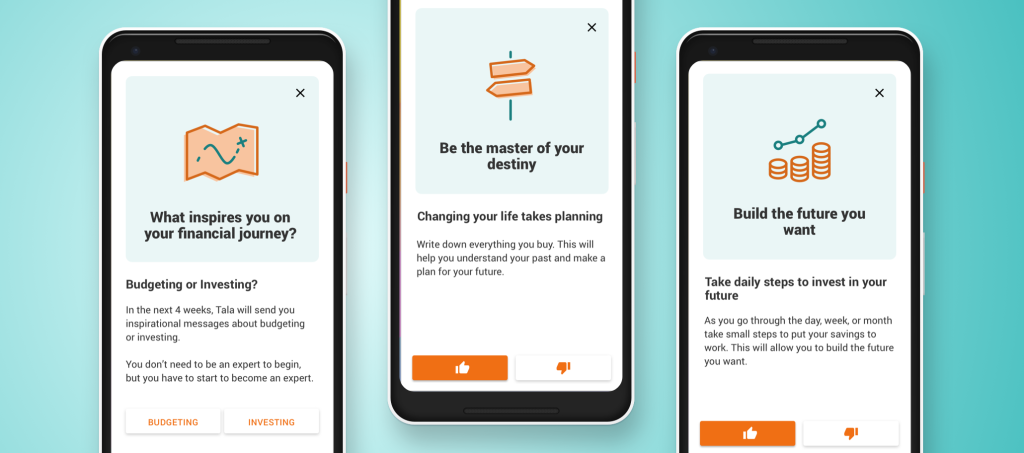

That’s why Tala launched Enlighten, a mobile learning platform that provides customers with easily digestible, inspiring financial advice to help navigate everyday financial challenges. Tips are delivered weekly via the Tala app on topics such as saving, budgeting, investing, goal setting and more. In emerging markets, where many consumers are new to formal financial services but smartphone penetration is high, this mobile-first product offers a compelling way for people to engage with an important but often neglected topic.

The promise of Enlighten is not only reflected in recent survey data revealing Tala as the top choice for receiving financial advice among recipients (beating out family and friends), but in the stories of customers taking action. One Enlighten recipient, Joseph, who works as a security guard in Nairobi, recently shared that after seeing an Enlighten tip on saving, he took a screenshot of the card and immediately shared with his wife. This small piece of advice prompted them to sit down that night and make a plan to save for a motorbike. He plans to use the bike to offer rides for extra cash. Joseph is one of the 78% of respondents who say they plan to change their financial habits based on Enlighten advice, demonstrating the power of bite-sized tips to inspire real action.