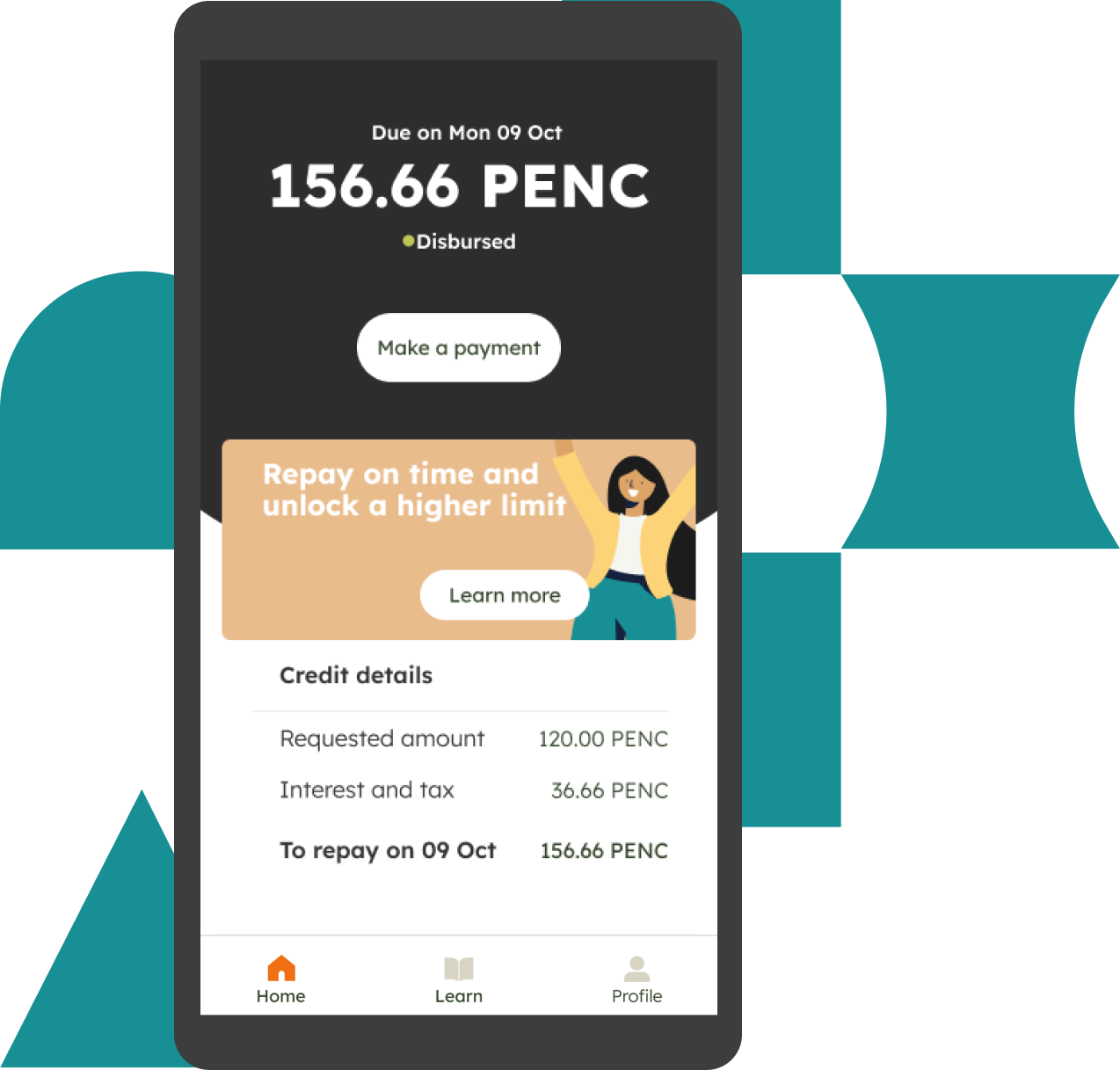

“When I got approved for a loan it was like a huge weight has been lifted off my shoulders because I don't need to worry about my water and electricity bills.”

Jean, Philippines

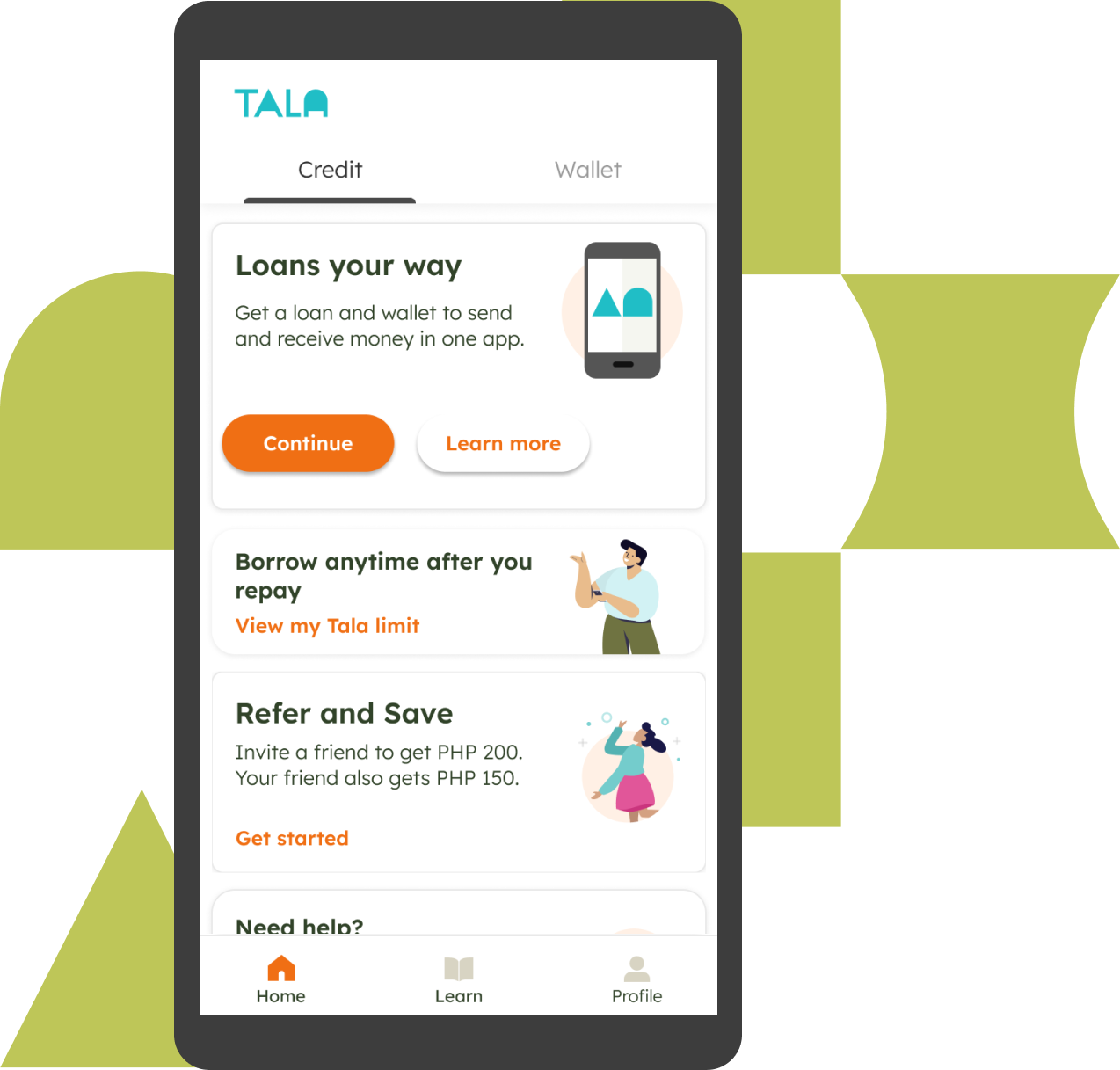

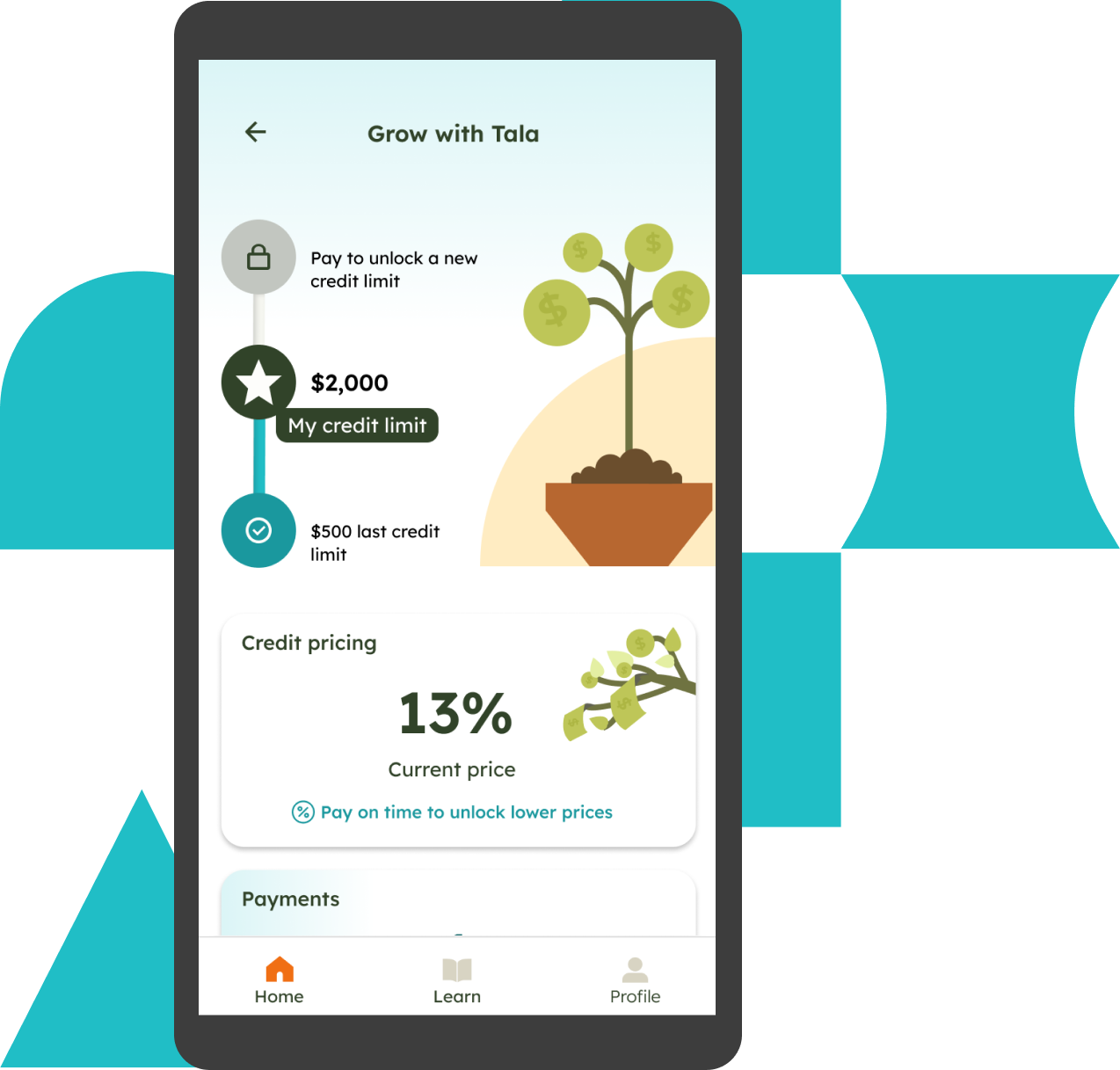

Tala’s personalized credit platform harnesses machine learning models trained on billions of proprietary data points from over a decade of customer relationships to underwrite millions of customers who have never interacted with the formal banking system.

We’ve reimagined credit from the ground up with Tala InSight—our patent pending credit decision model that uses causal methods to predict the terms and circumstances that will enable every customer to succeed, on a truly personalized basis.

Tala has built a plug-and-play banking solution that has the potential to serve any person in any country. This baseline proprietary software, which we call Tala in a Box combines our AI and data capabilities with end-to-end money supply chain infrastructure—supporting rapid launch and scale in any market we choose to enter.

Customers served

Continents and counting

Report improved financial management

“When I got approved for a loan it was like a huge weight has been lifted off my shoulders because I don't need to worry about my water and electricity bills.”

Jean, Philippines

“When no one was willing to help me start my dream career, Tala helped me go from baking with charcoal to baking with a clean and lovely oven. Tala trusted me to live my story.”

Baraka, Kenya

“Tala is a company for all working Mexicans. They consider you, even if you may not have a credit history. From the very beginning, Tala puts their trust and confidence in you.”

Alejandro, Mexico