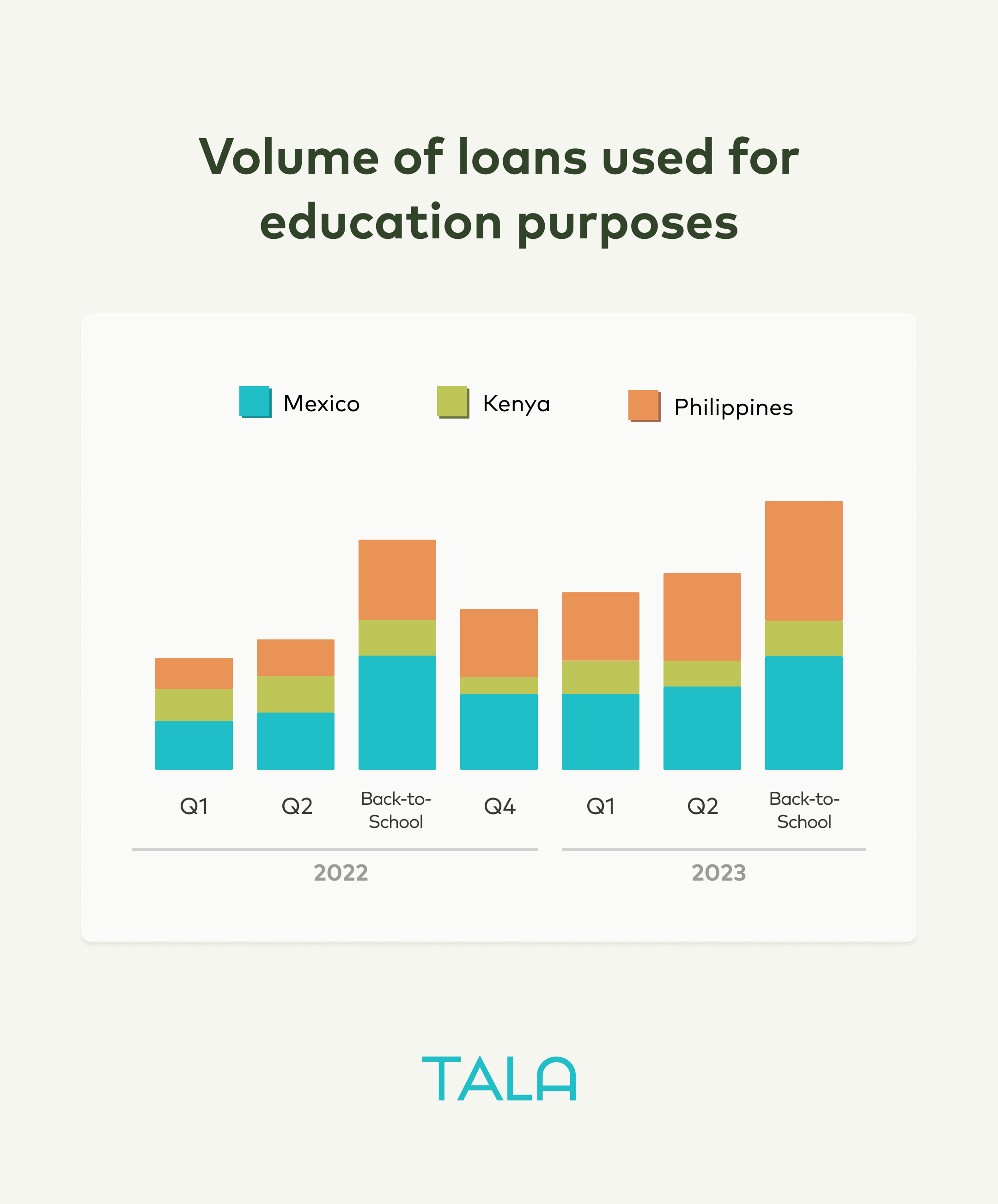

Every late summer, Tala sees a flux of customer activity as families prepare to send their kids back to school. Each school year brings up-front expenses, from school fees to supplies to clothing and uniforms — often stretching our customers’ household budgets. With rising education costs, we’ve seen a subsequent increase in loan demand. According to Tala’s anonymized, self-reported data from loan applications over the last several years, the number of loans taken for education purposes increases by nearly 50% during back-to-school months.

Key Findings

Approximately 15% of all loans are for education purposes in August and September.

Across our markets, additional money is needed during back-to-school months, so families have the supplies and resources for their kids to attend school. Taking a closer look market by market shows some unique differences: in Mexico, loans for school expenses double during back-to-school months — a consistent trend for the last three years. This year, education-related loans in Mexico were about 24% of all loans during back-to-school months. In the Philippines, approximately 50% more loans are taken for education purposes during back-to-school months compared to the rest of the year. Meanwhile, in Kenya, customers’ education expenses stay more consistent year-round, with about 10-15% of all loans being used for school-related purposes. We do see slight increases during August, September, and again in January when school fees for the second half of the school year are required.

Average back-to-school loans are 32% of monthly income.

Back-to-school expenses represent a significant portion of a family’s monthly income, as parents and guardians invest in essential supplies, clothing, and educational materials for their children’s return to school. In Mexico, the average back-to-school loan size this year was 2,100 MXN Pesos (~125 USD). This is more than one-third the average monthly income. According to our recent survey in Mexico, although 7 out of 10 participants claimed to have planned for back-to-school expenses, only 8% managed to fully cover these expenses out of pocket. In the Philippines, the average back-to-school loan size this year was about 5000 PHP (~90 USD). This has increased in recent years, equating to one-quarter of the average monthly income. In Kenya, the average loan size this year was about 17000 KESH (~120 USD), or over one-third of the average monthly income.

Education loans are predominantly taken out by women.

Generally, studies focused on expenditure data show that when women have access to financial services, including credit, households spend more money on children, education, and healthcare, increasing the welfare and productivity of their families. Looking at Tala’s anonymized loan applications where gender data is available shows a similar trend — education loans are predominantly taken out by women. In the Philippines, 70% of loans for education purposes are taken by women, and in Kenya and Mexico, nearly 50% of all education loans are taken by women.

Managing rising education costs

Education remains important for families worldwide. In our markets, although public education is common, it still requires additional costs, including supplies, uniforms, transportation, and textbooks, all of which families must bear personally. The findings from this report remind us of the financial strain associated with these expenses. Escalating education costs, too, have made it increasingly challenging for parents and students alike to manage their finances effectively and with peace of mind. At Tala, we’re creating solutions for all their financial needs, including mitigating the rising costs of education. We believe this is essential for the betterment of our communities and crucial for fostering a more equitable and promising future for all.

Notes on methodology

We analyzed anonymized Tala loan application data from 2019 to 2023 to understand the capital need for back-to-school expenses and rising costs in our markets — excluding India since we launched in 2020. Loan purposes, like school and education, are self-reported by customers.