Global

Menu

In the past decade, new technologies like mobile money and credit have accelerated financial inclusion around the world. The ability to safely send, store, and transact money via mobile phones enables more people than ever to participate in formal economic life, particularly those who have been historically excluded from traditional financial systems. For example, more than two million people have borrowed through Tala’s smartphone app, which allows anyone with an android smartphone to apply for a loan and receive an instant decision, regardless of their formal credit history.

With new technology, however, comes a responsibility to fully understand its impact on the communities it touches. As a company working to unlock financial access, choice, and control for billions around the world, Tala is committed to measuring our success not simply by traditional profits, but also by the impact on our customers’ lives and future. In this spirit, we recently set out to conduct a study on Tala’s impact in our first market: Kenya.

In objectively and transparently analyzing our impact in Kenya, Tala hopes to both improve our product and services to better meet the needs of our customers and start an open and honest dialogue about the responsibilities of digital lenders in emerging markets. By sharing this knowledge, we hope to help our industry adapt our products, services, and business practices to improve lives in Kenya and around the world.

The following report outlines Tala’s Impact Study methodology, key findings, and opportunities moving forward.

To fully understand Tala’s impact in Kenya, we set out to answer three primary questions:

1. What is the impact of small, short-term loans on our customers’ lives?

2. How healthy is repeat borrowing?

3. What opportunities and challenges exist for Tala to achieve its long-term mission of financial access, choice, and control for the emerging middle class?

Fulfilling Tala’s mission of unlocking financial access, choice, and control for billions of underserved people around the world requires both short and long-term results. Therefore, we chose to assess our impact in two categories: immediate impact and long-term impact. Multiple indicators comprised each impact category.

Immediate Impact

We measured Tala’s immediate impact with two indicators: income smoothing and emotional relief.

Income smoothing – the ability of Tala loans to effectively provide stability and counteract the negative impacts of uneven income and expense flows

Emotional relief – the effectiveness of Tala loans at reducing the emotional anxiety of customers in regards to their financial lives

Long Term Impact

Over two months, we studied Tala’s long-term impact with three indicators: financial growth, financial access, and financial literacy.

Financial growth – Customers’ ability to leverage credit for business or personal income growth

Financial access – Increased access to multiple credit options, including traditional financial institutions

Financial literacy – Growth of customers’ financial understanding and knowledge, especially when it comes to using credit

Research methodology

To measure change in the indicators outlined above, we conducted a baseline survey with 795 randomly selected Tala customers, and a follow-up survey two months later with 277 customers of the original sample, both distributed by income, gender, livelihood, and how many loans they had taken at Tala. We then analyzed mobile data from a randomly selected 1,000 customers.

We also conducted 90-minute in-depth interviews with 24 customers from our follow-up survey, distributed by age, gender, livelihood, and neighborhood in Nairobi. To ensure the findings were representative of Tala’s user base, we took care to select a sample that accurately reflected our active borrowing population.

In addition to direct customer research, we conducted expert interviews with representatives from Frontier Associates in Kenya and the Center for Financial Services Innovation (CFSI) in the United States. We are grateful for their advice and guidance.

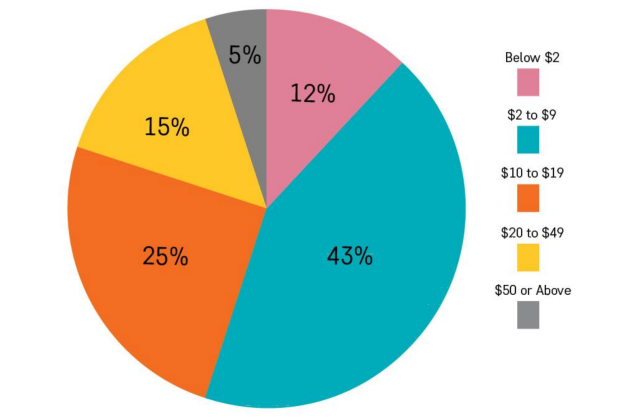

The majority of Tala’s customers in Kenya are well-educated, between 25-34 in age, and part of the emerging middle class, earning $2-$19 per day. Most are steadily employed or entrepreneurs with small or micro-businesses. In some ways, this mirrors the profile of typical microfinance clients who are denied access to banks and other formal financial institutions: self-employed in the informal economy.[1]

However, Tala’s customers have a higher income than the typical microfinance client who on average earns close to the international poverty line at $1.90 per day.[2] As existing research shows that the impact of microfinance across socio-economic groups is most significant for households in the top quartile of microfinance clients, and for younger populations,[3] the age and income range of Tala’s customers is, therefore, in line with groups that have historically benefited the most from microfinance.

Unexpected financial expenses

Almost all respondents (90%) experienced significant unexpected financial expenses in the past year, with 34% having more than one. The most common cases were business difficulties and emergencies with family and friends. The frequency of emergencies was similar between our initial and final survey, indicating that these issues are persistent over time.

Income volatility

Unstable income affects both entrepreneurs and salaried employees in Kenya. While income shocks are expected among emerging entrepreneurs, we also saw many salaried workers facing the same income volatility. For example, one respondent, Hillary, who despite being steadily employed as an accountant for over four years, described how income volatility is causing him to fall short of his living expenses and his CPA school fees:

“Sometimes there is a delay, so it’s not a reliable date, sometimes it takes two months to get paid…As I told you, most cases my salary is delayed.”

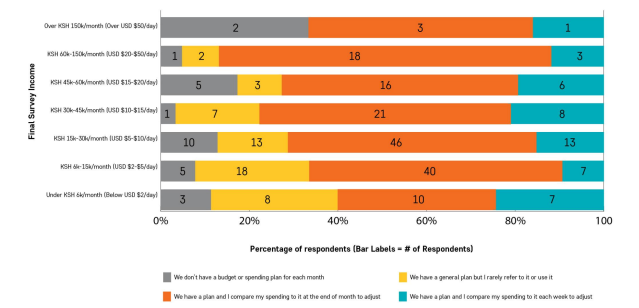

Living with uncertainty, the majority of Tala’s users have become active money managers with monthly budgets. This is resonant with the findings from FSD Kenya‘s seminal work in the Kenya Financial Diaries. In fact, as the chart below indicates, our customers in the lowest income brackets are the most likely to budget and monitor their spending regularly.

Respondents confirmed that Tala successfully provides immediate income smoothing and emotional relief for our customers.

Income Smoothing

At Tala, our immediate value proposition to customers is to help them deal with uneven income and expenses by being a reliable source of credit anytime they need us. Interviews showed clear usage of Tala loans to effectively smooth income and expense shocks. Many customers reported that Tala loans helped them pay for school fees, cover medical bills, and even keep their businesses open.

In fact, 70% of entrepreneurs described using Tala to help keep their businesses running through periods of uncertain income:

“Without Tala, I would earn more slowly or miss out on opportunities for income when my clients want my product, but I don’t have the funds for it.” — David, Fast Food Business Owner

“When I need to service my cars and don’t have enough money out of pocket, I use Tala. It allows my business to run smoothly.” — Kenneth, Taxi Business Owner

“Last year I had an accident and had to use almost all my money to get treatment. Tala helped me to add at least one bale [of duvets to sell] so the shop didn’t close.” — Calvin, Shop Owner

“My customers usually don’t pay for the clothes immediately, so I usually borrow to ensure I can go to the market and buy goods for sale as I wait for payment.” — Grace, Hospital Worker & Clothing Entrepreneur

Similarly, salaried customers cited numerous cases of successfully using Tala to manage income:

“There was a day when the token (electricity) went out and I had no money, so I used Tala for that. I also had to pay for exams. I had a balance of about 2,200 Ksh. I went back to Tala so that I can sit for the exam” — Peter, University Student

“Because my salary was often delayed, I’d fall behind on school fees and either couldn’t sit for exams or have to pay 50% more for paying late. Now I can pay my fees on time” — Hillary, Accountant

“My son was diagnosed with eczema. The loans have mostly helped with paying for his treatment” — Kevin, Logging Industry Consultant

Emotional Relief

As research shows that people under stress tend to make poorer financial decisions,[4] it is important to measure how Tala affects our customers’ stress as it relates to effectively dealing with life’s shocks. In-depth interviews called out the significant emotional impact of Tala’s services. We heard clear stories about how Tala reduced our customers’ mental, and sometimes even physical, stress. One customer, Grace, for example, finds security in knowing that Tala is a reliable option if she ever runs into trouble between paychecks.

“Tala has changed my life for the better. There are those small expenses where you’d have to ask a friend, but now I know when I need the money I’ll be sorted. I can get 3,000 Ksh that will be sorted for the next two weeks” — Grace, Hospital Worker & Clothing Entrepreneur

Meanwhile, another customer, Peter, told us that he literally suffered from ulcers prior to having Tala as a bridge for when his rent comes due and his salary arrives late, which made monthly budgeting difficult.

“Rent was wanted on 5th, salary was staying up to 7th… I decided, Tala money I access earlier than my salary.” — Peter, Security Guard

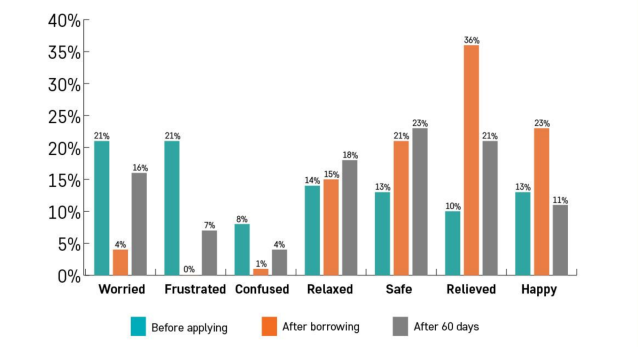

Survey data validated these findings. We asked customers how they felt about their financial life before and after they took their loan, and 60 days later after the repayment period (loans are due within 21-30 days). In the chart below, emotions are arranged from the most negative on the left to the most positive on the right. As expected, a tremendous increase in positive sentiments can be seen right after receiving a Tala loan (“after borrowing” in graph). What we did not expect was that the positive emotions would carry through the entire loan cycle with 55% of customers feeling positive sentiments about their financial life throughout the loan cycle, higher than the 36% when they applied.

This is important because by providing emotional relief, Tala loans put customers in a better position to handle fluctuations in their lives.

While we were encouraged by the positive short-term impact of Tala loans, Tala’s mission is firmly rooted in the long-term financial aspirations of our customers. As mentioned, we defined long term impact in three components: financial growth, financial access, and financial literacy.

Leveraging Tala to Grow

Our surveys revealed that Tala customers leverage loans to grow their income in a variety of ways. Many customers are entrepreneurs or employed with side businesses. They have clear business plans for themselves and take Tala credit in order to continually fuel their business growth. They also hope to grow with Tala to make larger investments in their businesses that could transform their income potential. Indeed, 15% of respondentsdescribe business expansion as their primary reason for using Tala.

“I used my first loan to increase my stock from one bucket to a sack of potatoes. Over time, I’ve also been able to buy equipment to provide more snack options in my hotel. My profits have gone from 3,000 Ksh to 9,000 Ksh per month.” — Jacqueline, Hotel Owner

Another 15% of respondents mentioned starting a side business as their use case for Tala.

“Tala helped me start my business. I started with a 3,000 Ksh Tala loan to buy sweaters to resell. That amount was not in my budget at that time.” — Grace, Hospital Worker & Clothing Entrepreneur

“I hope to reach 15,000-20,000 Ksh from Tala to open a bar. It will cost 50,000 Ksh, so I’m saving this year and will add the Tala loan to that total.” — Walter, Soldier & Shop Owner

For others, repeat borrowing is about planning for the future, even if they do not have a specific need for the credit, similar to many in the United States who build credit limits to ensure access when it is needed. In a world of uncertain cash flows, the security of knowing that any opportunity or problem could be accessed or solved with a single loan is a highly attractive proposition that Tala fulfills.

Importantly, these different motivations behind frequent borrowing reveal that frequent borrowing is not necessarily unhealthy. Instead, different segments are employing the same behavior to fulfill different needs and plans. This speaks to an opportunity to begin customizing borrowing tips to different groups in order to maximize Tala’s relevance and impact.

Out of scope for this two-month study was direct income growth over time. Tala recognizes that the two-month period between our surveys would not likely be long enough to observe any significant change in income, however, we still want to better understand how customers are using Tala to foster income growth in a future study.

Access to Credit

Although Tala’s app itself provides financial access and control to our customers, we are equally committed to unlocking financial choice for our customers. This requires that they have multiple options to access credit. Therefore, as a part of this study, we sought to understand our customers’ existing credit options.

Encouragingly, the financial landscape in Kenya has changed significantly in past few years, as new mobile money providers allow more Kenyans than ever to access financial services. For example, in 2013, as Tala prepared to launch in Kenya, there were no strictly digital lenders operating in the country. Outside of traditional banks, which many in Kenya distrusted or were excluded from, options to access credit were limited. Since 2013, digital lenders and other mobile money institutions have become widespread. The proportion of Kenya’s adult population that has accessed a formal financial service rose from 77% to 88% from 2013 to 2017.[5]

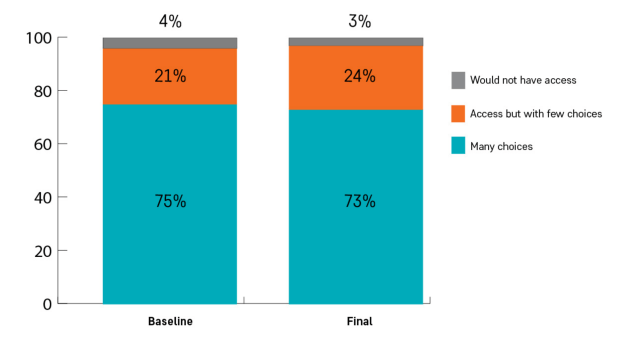

Reflecting this shift, the majority of Tala’s customers in Kenya now have relatively high access to credit.We found that only 2% of our customers are still using informal, and often exploitative, money lenders. Additionally, 57% of respondents described accessing digital credit in the past 60 days. This confirms the fundamentally changed state of the lending industry in Kenya, where digital lending is now commonplace.

Q: What reflects your financial situation when it comes to borrowing money

Finally, we sought to explore the “graduation” of digital credit customers to traditional bank loans. While Tala reports positive credit history to Kenya’s Credit Reporting Bureau (CRB) to help our customers build their public credit record, we were not able to discern over two months whether customers were able to leverage Tala’s credit history to obtain loans from banks, or if banks are the ideal measure of financial access in Kenya. Explaining part of the declining reliance on banks for credit, our interviews revealed that customers continue to strongly distrust banks, citing hidden fees, lack of flexibility, and aggressiveness when unable to repay on-time. Baseline Survey Final Survey

Financial Literacy

Since digital loans are the first experience many of our customers have with formal credit, it is critical that we continue to improve how we educate customers. Although Tala’s app and credit application take great care to educate customers on the details of our loan agreements, we wanted to better understand how strong the need is for broader financial and credit education.

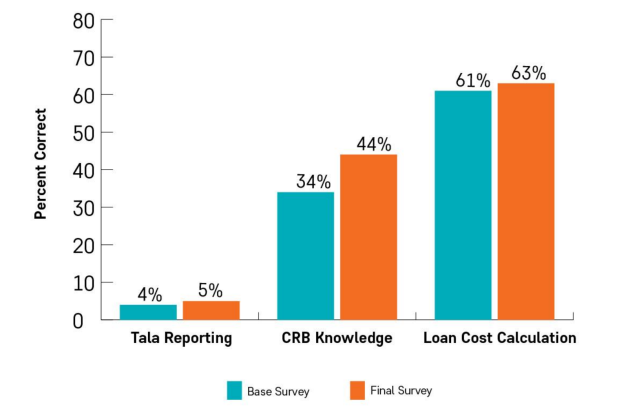

Our survey results indicate that the act of borrowing money through a user-centric designed app alone, does not necessarily improve financial literacy. There is an opportunity to explore adding broader financial education into our product, which could not only help raise the overall financial health of our customers, but also help mitigate the chances of customers becoming over-indebted from simultaneously taking out loans with multiple lenders.

Additionally, while we did find some growth in awareness around Kenya’s Credit Reporting Bureau (CRB), borrowers generally have widespread awareness but shallow understanding of the CRB.Most are aware of the CRB only as a punitive institution where defaulters can be “blacklisted,” but not much more. Interviews revealed that the majority of customers learned about the CRB from negative experiences, whether their own or from friends. This suggests that more active measures are needed to educate Kenyans on the Credit Bureaus’ responsibilities and operations.

Moreover, 95% of our customers did not fully understand that Tala reports positive credit performance that can build our customers’ credit identity and potentially help them access additional financial services. Accordingly, since conducting this study, we have added more education on reporting into our product and customer communication channels. Tala is also currently working with FSD-Kenya, and other leading digital lenders to form a group to contribute to the integrity and stability of Kenya’s growing digital lending sector.

The study revealed that Tala credit has a positive immediate impact on our customers’ lives by smoothing income shocks and reducing emotional stress. It also revealed many ways Tala customers are leveraging our loans to expand their businesses and improve their livelihoods. Key areas where further study is needed also emerged from our research, such as the effect of small loans on income over time, the most appropriate channels to increase financial access in Kenya, and how best to educate customers to improve overall financial literacy. Tala is committed to addressing the questions raised in this study, and improving Tala’s product and services to better meet our customers’ needs.

As a start, in 2018, we launched our first in-house research division, called Product Impact & Insights, and have begun ramping up customer research across all our markets. Since conducting this study, our research team has expanded from two researchers to seven with plans to hire more. Tala has also collaborated with research organizations like the Center for Financial Services Innovation (CFSI) to further our understanding of the impact of short-term digital credit in Kenya. In partnership with CFSI, Tala launched a more robust survey to develop our own financial health score for Tala customers. In expanding our research efforts and sharing the insights from this study, we hope to help the industry adapt our products, services, and business practices to unlock financial opportunity in Kenya, and around the world.

[1] FinDev Gateway – CGAP. Retrieved from www.microfinancegateway.org/what-is-microfinance

[2] Hickel, J. (2018). Could you live on $1.90 a day? That’s the international poverty line. [online] the Guardian. Available at: www.theguardian.com/global-development-professionals-network/2015/nov/01/global-poverty-is-worse-than-you-think-could-you-live-on-190-a-day [Accessed 27 Oct. 2018].

[3] MEDICI. (2018). The Impact of Microfinance. [online] Available at: https://gomedici.com/impact-of-microfinance/?__s=ciqr1ozttspxwk6zpssw [Accessed 27 Oct. 2018].

[4] Starecheski, L. (2018). NPR Choice page. [online] Npr.org. Available at: https://www.npr.org/sections/health-shots/2014/07/14/330434597/this-is-your-stressed-out-brain-on-scarcity [Accessed 27 Oct. 2018].

[5] Finclusion.org. (2018). [online] Available at: http://finclusion.org/uploads/file/kenya-wave-5-report_final.pdf [Accessed 27 Oct. 2018].